The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. Sometimes investors adjust the figures of guide to lenders review a debt-to-equity ratio just to include long-term debt. This is because long-term liabilities are more expensive and risky than short term debts. The debt-to-equity ratio is another important tool in corporate finance assessment. It demonstrates a company’s financial leverage by using basic information from its balance sheet.

How to Compute Debt to Equity Ratio

- They can also issue equity to raise capital and reduce their debt obligations.

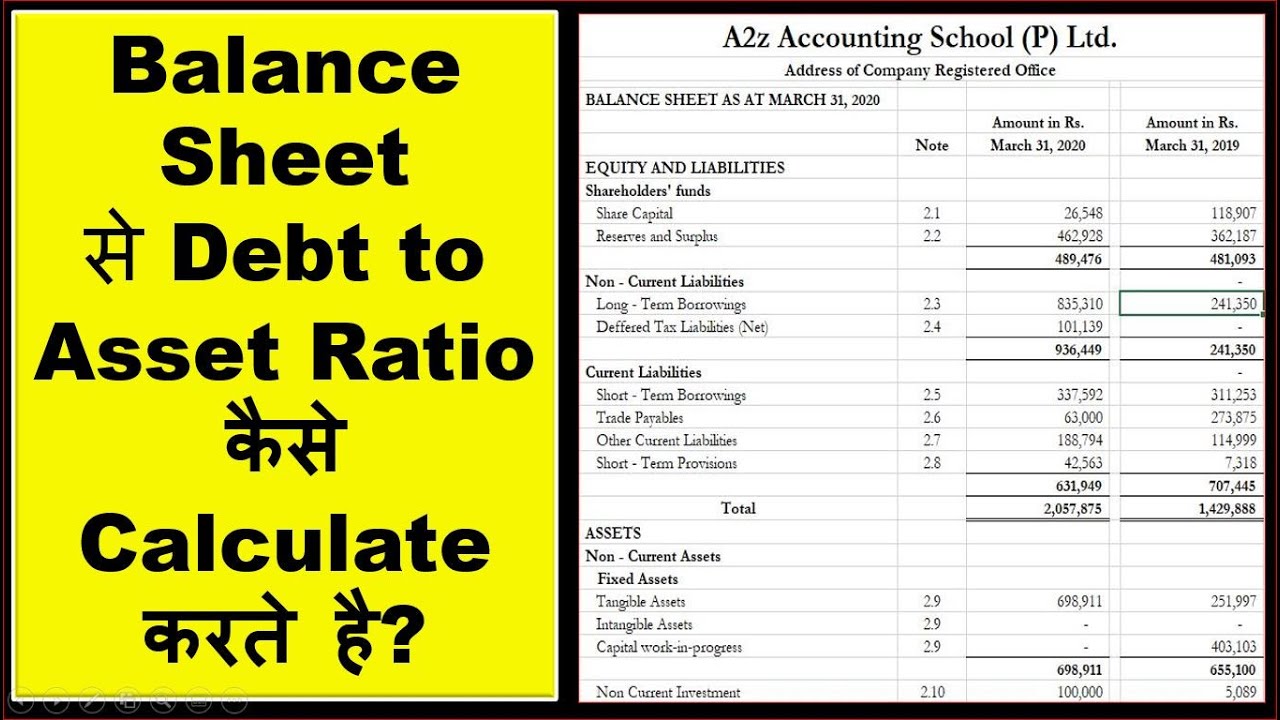

- When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations.

It is usually preferred by prospective investors because a low D/E ratio usually indicates a financially stable, well-performing business. By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions. Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle.

What is your current financial priority?

It’s crucial to consider the economic environment when interpreting the ratio. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns. As established, a high D/E ratio points to a company that is more dependent on debt than its own capital, while a low D/E ratio indicates greater use of internal resources and minimal borrowing.

Importance of the Debt to Equity Ratio

For example, let us say a company needs $1,000 to finance its operations. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. Gearing ratios are financial ratios that indicate how a company is using its leverage. A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt.

The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. The data required to compute the debt-to-equity (D/E) ratio is typically available on a publicly traded company’s balance sheet. However, these balance sheet items might include elements that are not traditionally classified as debt or equity, such as loans or assets. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt. It is calculated by dividing the total liabilities by the shareholder equity of the company.

Sales & Investments Calculators

The reason for this is there are still loans that need to be paid while also not having enough to meet its obligations. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. In some cases, companies can manipulate assets and liabilities to produce debt-to-equity ratios that are more favorable. If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt.

When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates. Different industries have varying capital requirements and growth patterns, meaning that a D/E ratio that is typical in one sector might be alarming in another. Capital-intensive sectors, such as utilities and manufacturing, often have higher ratios due to the need for significant upfront investment. In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios.

It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations. In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities. For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations.

The periods and interest rates of various debts may differ, which can have a substantial effect on a company’s financial stability. In addition, the debt ratio depends on accounting information which may construe or manipulate account balances as required for external reports. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.