Using the right payroll software can automate calculations, reducing manual effort and the risk of errors. This also simplifies reporting, providing readily available data for financial statements and analysis. Understanding how vacation pay is managed and its influence on financial statements is key to accurate accounting. For a deeper look, check out this helpful resource on managing vacation pay.

- Accrued Vacation Pay and Its Impact on Financial Management reinforces the importance of this in financial planning, emphasizing its effects on both balance sheets and cash flow.

- Additionally, some states have specific requirements for accrual rates or payouts upon termination.

- If you’re looking for expert guidance on managing your accounting processes and ensuring compliance, contact FinOptimal.

- However, if the purpose of the leave is to provide compensated time off without restriction, then an accrual over the requisite service period is appropriate.

- Many employers provide vacation time to employees, but employees might not use their earned vacation right away.

Accrued vacation journal entry

I just need to know what account is on the other side of my “Vacation Accrued” liability account to post the second half of the journal entry. For hourly workers, the current pay per day would be computed as the hourly compensation rate on the date of accrual multiplied by the total number of hours to be compensated for one day. The hourly compensation rate should include the related cost of fringe benefits and employer taxes earned. For salaried workers who are paid by the year, divide the annual salary, including the cost of fringe benefits and employer taxes, by the average number of days worked each year. Recording accrued expenses (as opposed to sticking with cash basis accounting) can have a big impact on how you understand your business’s financial position and cash flow. If you run your business using cash accounting, you record expenses the moment you pay for them, and you won’t have accrued expenses in your books.

Construction Accounting 101 & 8 Options to Choose From

The best frequency for your business depends on its size, complexity, and internal processes. A larger company with frequent employee turnover might benefit from more frequent accrual entries, perhaps even aligning them with each pay period. Consider what makes the most sense for your business structure and resources.

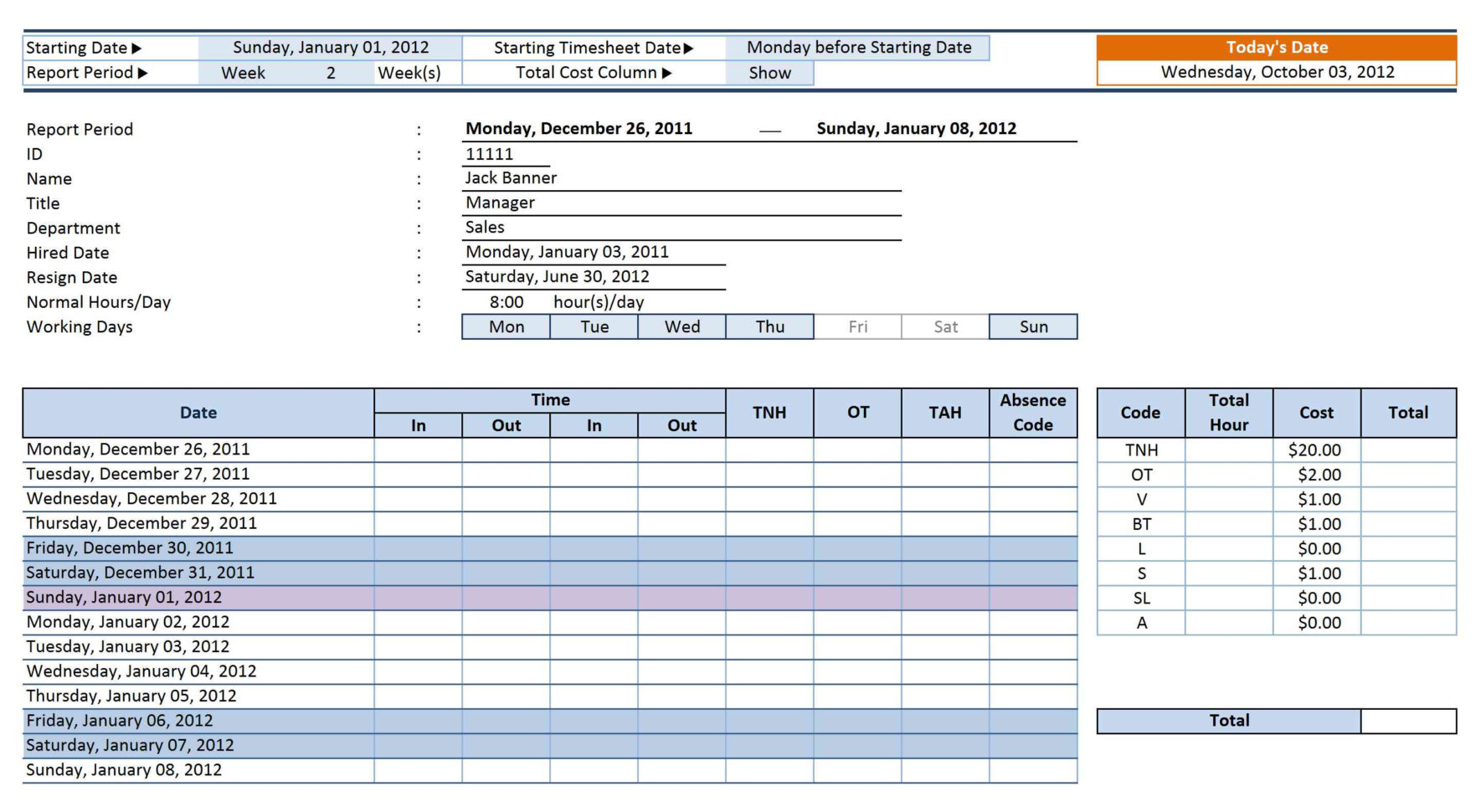

Accrued Vacation and Time Off Template

Our punch limiting setting ensures employees can only punch in/out at the start and end of their shift. So employees can’t punch in too far from when their shift ends or begins. Calculating vacation accrual is slightly different for full-time salaried employees, given that these employees are counting their time worked in days as opposed to hours. Because of this, vacation accrual journal entry salaried workers typically earn vacation accrual for every certain number of days worked. By providing employees with the tools to manage their vacation time, employers can ensure that their workforce remains healthy, productive, and engaged. At the end of January 2025, the company calculated that employees had earned an additional $3,000 in vacation time.

Company

To use with your existing payroll provider, you can integrate Buddy Punch with your provider or export the data to a CSV. This lets you track accurate time records, your employee’s pay rates, and pay them through your payroll provider. Since vacation accrual is maintained in Buddy Punch, employees don’t need to leave Buddy Punch to request PTO. They can request time off and view their PTO balance in Buddy punch.

Legal and Compliance Risks

For example, suppose John Smith has 60 hours of accrued vacation time. The amount due to employees for unused vacation appears as a liability on your balance sheet until paid. The amount also appears on your income statement as an expense in the period during which it became due. In this article, I explain the step-by-step process of adjusting vacation accrual.

Accrued vacation is typically recorded as a liability on a company’s balance sheet because it represents an obligation the company owes to its employees. But we also take a step back and look at what a business needs to accurately track vacation accruals for their employees. When you’re trying to calculate vacation accrual, you must have an accurate employee time tracking system in place. Without this step in place, you’re not going to get accurate accruals. The two software tools commonly used to calculate and record accrued vacation are payroll and accounting software solutions.

It’s considered a liability—a financial obligation—that needs to be recorded in your financial statements. This liability reflects the amount your company owes employees for their earned but unused vacation time. Essentially, it’s money you’ve set aside, earmarked for future vacation payouts. Generally Accepted Accounting Principles (GAAP), take a look at this guide on accounting for accrued vacation. When vacation pay accrues, it’s recorded as a liability on your balance sheet, clearly showing the amount your company owes for this earned time off. To understand the impact of accrued vacation pay on financial management, explore this insightful article on managing vacation pay.

Other common time frames to record unused vacation leaves are once per fiscal year or on the employee’s hire date. It is useful to note that the accrued vacation is an estimate, so the amount may be different from the actual payment. However, it is not required for the company to restate the amount in the previous period. Any difference can be adjusted at the current accounting period unless the difference too significant which could be classified as an error or fraud.

This is where you can select when the employee took vacation, and I added an option for sick as well in case you wanted to track that as well. Great job with the steps you’ve taken so far, and I appreciate what you’ve described here with how your payroll works. If you are Allowed or Required to accrue, you pay out the Liability. You don’t pay out “true” expense, because you already reported and posted Expense, as the offset of that Liability. I an in Montana, and my governmental clients must show Accrued Value and Time, but they are not Linked. The Value to accrue as liabilty is All of vacation and 1/4 sick, for example.