A good D/E ratio of one industry may be a bad ratio in another and vice versa. Banks also tend to have a lot of fixed assets in the form of nationwide branch locations. The D/E ratio is much more meaningful when examined in context alongside other factors. Therefore, the overarching limitation is that ratio is not a one-and-done metric. These industry-specific factors definitely matter when it comes to assessing D/E. When assessing D/E, it’s also important to understand the factors affecting the company.

Loan Calculators

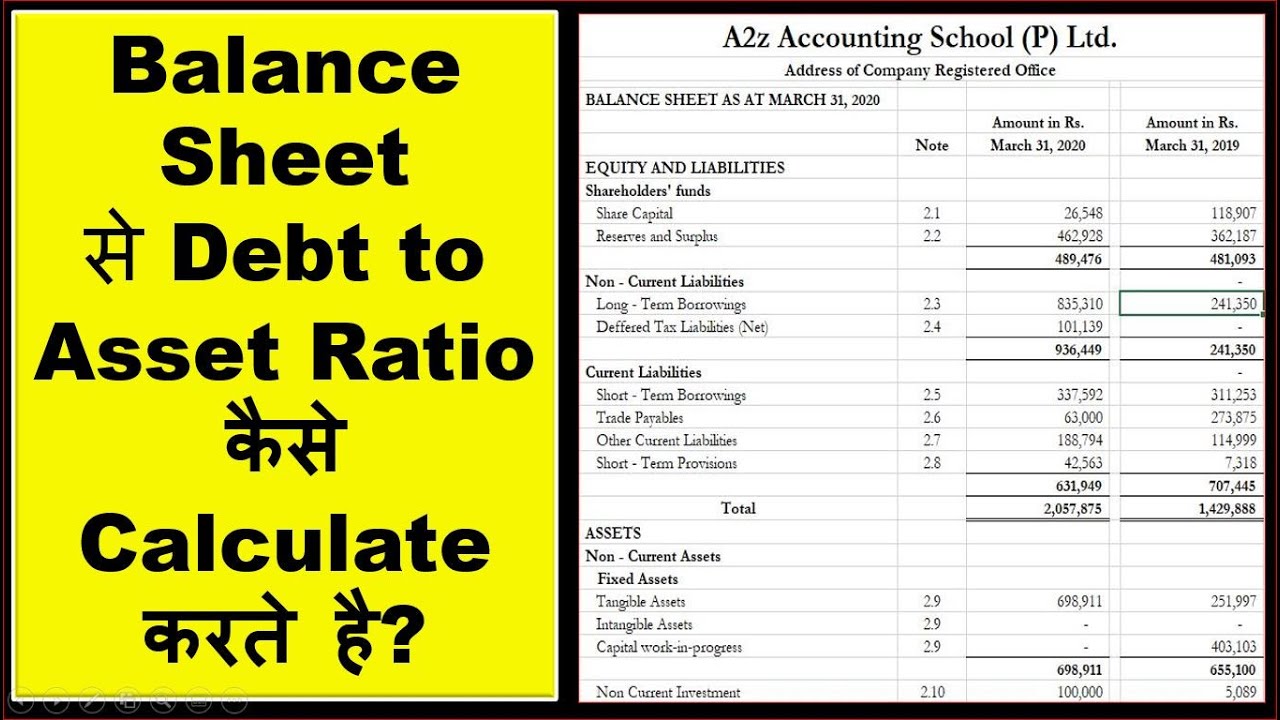

A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets. Meanwhile, a debt ratio of less than 100% indicates that a company has more assets than debt. Used in conjunction with other measures of financial health, the debt ratio can help investors determine a company’s risk level. Because debt is inherently risky, lenders and investors tend to favor businesses with lower D/E ratios. For shareholders, it means a decreased probability of bankruptcy in the event of an economic downturn. A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source.

Ask a Financial Professional Any Question

This is because when a company takes out a loan, it only has to pay back the principal plus interest. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in solving resource capacity problems a liquidation scenario. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. A D/E ratio of about 1.0 to 2.0 is considered good, depending on other factors like the industry the company is in.

Part 2: Your Current Nest Egg

In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy. However, it could also mean the company issued shareholders significant dividends. The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity). Publicly traded companies that are in the midst of repurchasing stock may also want to control their debt-to-equity ratio.

Create a Free Account and Ask Any Financial Question

The cash ratio is a useful indicator of the value of the firm under a worst-case scenario. Aside from that, they need to allocate capital expenditures for upgrades, maintenance, and expansion of service areas. Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P.

Sports & Health Calculators

The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. A higher debt to asset ratio suggests greater financial risk, as more assets are financed by debt, increasing interest obligations and potential insolvency risk during downturns. A ratio above 50% suggests that more than half of the company’s assets are financed by debt, indicating potentially high leverage and financial risk. Common debt ratios include debt-to-equity, debt-to-assets, long-term debt-to-assets, and leverage and gearing ratios. Acceptable levels of the total debt service ratio range from the mid-30s to the low-40s in percentage terms.

For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Company B has quick assets of $17,000 and current liabilities of $22,000. For instance, a company with $200,000 in cash and marketable securities, and $50,000 in liabilities, has a cash ratio of 4.00.

- In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain.

- The D/E ratio contains some ambiguity because a healthy D/E ratio often falls within a range.

- As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade.

- But if it’s particularly higher or lower than that industry standard, it might be worth interrogating your finances further – particularly if you’re looking for investment.

Generally speaking, a debt-to-equity ratio of between 1 and 1.5 is considered ‘good’. Currency fluctuations can affect the ratio for companies operating in multiple countries. It’s advisable to consider currency-adjusted figures for a more accurate assessment. This result indicates that XYZ Corp has $3.00 of debt for every dollar of equity. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.