Posts

Having fun with analysis away from primary source, including the Assistant from Condition workplaces in all 50 states, Middesk support their people make sure organizations seeking discover deposit profile, pull out finance otherwise get onboarded to help you money rails while keeping fake organizations away. Even with fighting which have history databases including Dun & Bradstreet and Lexis-Nexis, that it business already has 600 users, and national and you will regional financial institutions and you may organization financial fintechs for example Mercury and you may Bluevine. From the 2008, on line banking try available to house depositors and you may small enterprises.

Brief vendors often, certainly, drill off regarding the regulating study filed by four financial institutions to determine the term of your lender in the study, therefore government authorities and you can Congress must disperse this dilemma instantly to reach the top of their financial crisis concern listing. Mentormoney.com), a respected on the internet monetary markets where you are able to shop for fund and you will playing cards. Zack ‘s the bestselling composer of the new blockbuster book, The fresh LEMONADE Lifetime. Apple entitled The new Lemonade Lifestyle certainly one of “Fall’s Greatest Audio books” and you can an excellent “Must-Listen.” The fresh Lemonade Lifestyle premiered because the #step 1 new business publication to the Fruit bestseller graph.

The powerful fundraising model says to founders simply how much the limits would be toned down inside state-of-the-art early-phase rounds, and an offer letter device immediately status the new cover table whenever a different personnel allows. Just last year, Pulley first started record token distributions to own Web3 and you will blockchain businesses. Such, Very first Republic, that has been seized and you will offered to JPMorgan Pursue after in initial deposit work with, sold the people jumbo mortgages at the lowest rates, that has been an excellent “crazy offer,” he said. Older lender lending officers advised the newest Fed recently inside the a every quarter questionnaire which they expect they are going to tense conditions to your the fresh fund all year. Founded in the 1985, Earliest Republic ‘s the 14th premier You lender because of the assets, with 212 billion after 2022.

Aguirre, an enthusiastic SEC feet soldier, is trying so you can interviews a major Wall structure Path executive — perhaps not handcuff the guy otherwise impound his boat, actually, merely correspond with your. Mack himself, at the same time, was being represented by Gary Lynch, an old SEC movie director from enforcement. More than products from the a pub to the an excellent dreary, cold nights within the Arizona the 2009 month, an old Senate investigator chuckled as he refined away from his beer.

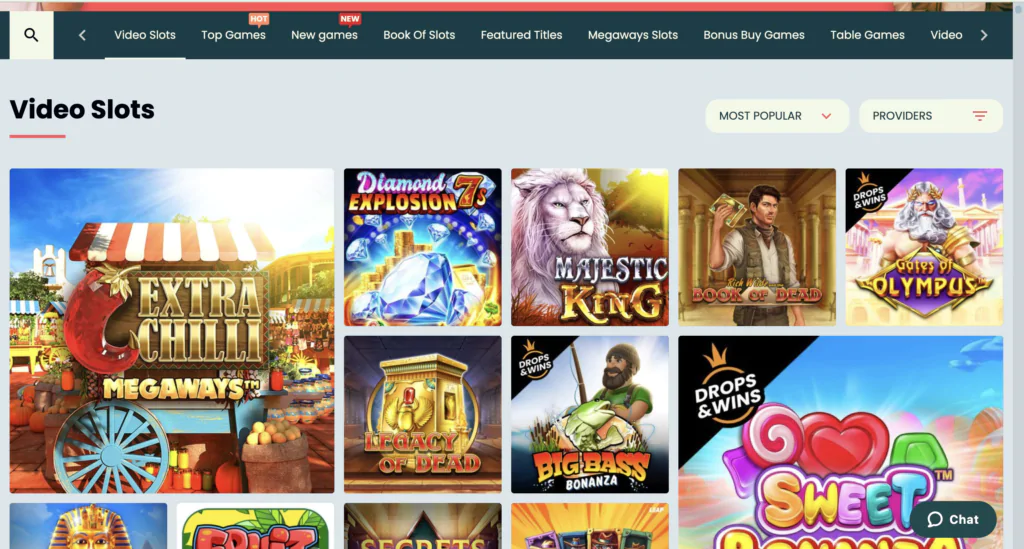

The fresh scam strategy under consideration went semi-viral the 2009 month, sometimes beneath the hashtag “#fidelityboyz.” In one single article that has more than 4,five hundred enjoys to your Instagram, multiple males wear Fidelity T-tees are seen organizing large volumes of cash floating around. Citi, for instance, advised the newest outlet they rates casino Super Diamond financial institutions features anywhere between five-hundred billion and 700 billion in excess, non-interest-using deposits. Lender deposits generally improve each year, nevertheless increase in the places away from organizations and you will users exactly the same one to has inundated banks since the COVID-19 pandemic first started is so it’s hard for this year’s complete so you can outpace 2021’s.

However, this week it been to buy right up nonsense-thread Replace Replaced Financing (ETFs) and said it does soon start making downright sales away from each other financing stages and you may rubbish-rated business bonds. For this reason, the new interest in so-called safer property supported the new 100 percent free flow away from investment for the homes in the united states. That it considerably worsened the new drama since the banks or any other financial institutions had been incentivized so you can issue more mortgages than before. Corporate personal debt trade system you to performs high investments of investment-degrees, high-yield, disappointed and emerging business ties to possess users in the 815 loan providers.

Casino Super Diamond | Yearly commission give

“Raising funding against places and you can/otherwise flipping away places is actually abnormal tips to possess financial institutions and cannot be great to the program in the end,” Jennifer Piepszak, JPMorgan Chase’s co-Chief executive officer out of individual and you may people financial, told buyers last year. The objective during the Stash is to find people to begin investing — indeed, we’lso are probably the merely monetary coach available to choose from who does prompt our very own people to give you less money to start. Adding a little bit several times a day really can add up through the years, so we’re trying to build wiser using patterns that may place all of our Stashers right up for very long term financial achievements. Like other micro-investing software such as Acorns and you may Robin Bonnet, Nyc-based Stash cannot charges commissions for buying or selling stock. There’s an enrollment payment away from step 1 monthly account less than 5,000, and you may 0.25percent annually to own stability more 5,100000. 5 million is create anywhere between 150,one hundred thousand to 250,000 within the inactive money in the apparently safer investment.

Dashboard Soars 53percent inside the Six months: Look at Whether it’s However a must-Pick Inventory!

We assist instruct our very own people and make behavior on their own with information and you can assistance from your Stash Coach. We have an information center called Understand and therefore directs Stashers enjoyable resources and articles one to break apart tricky topics such as diversity, holds versus. bonds, compound desire, and a lot more. We’lso are very pleased with Discover and have had an overwhelmingly positive effect from your Stashers. “We dedicated to Hide while the i spotted it fulfilling a definite business you would like early for the,” told you Chi-Hua Chien, dealing with partner out of Goodwater Financing, which focuses primarily on early phase consumer tech investment and you can co-contributed (having Valar Potential) Stash’s Show A great fundraising round.

The lending company’s trajectory moved on abruptly 30 days back once a great disastrous fourth-quarter declaration where it posted a surprise loss, cut the dividend and you may amazed analysts with its amount of loan-losings conditions. MicroStrategy, just after primarily a business application supplier, could have been to buy bitcoin since the August 2020. They ramped up acquisitions of your token this season—particularly after the Donald Trump’s November 5 election winnings—while the people bet on a good crypto-amicable management and Congress. Offers inside MicroStrategy (MSTR), the greatest corporate proprietor out of bitcoin (BTCUSD), popped pre-industry then stopped course to help you change lower Tuesday following the program company said it got bought 5.4 billion of one’s cryptocurrency.

Fed’s action to your drama

Who features delivered the brand new outflow away from deposits because the prevent of one’s very first one-fourth away from 2022 so you can a massive 230.6 billion, and you may showing that the financial missing dumps inside the five of the last six home. Nevertheless, Abouhossein told you there’s potential for UBS so you can recover element of the fresh nearly five-hundred billion inside places and you can assets you to definitely left Borrowing Suisse over the very last two years. The newest analyst told you large deposit prices was probably being used to help you limitation outflows at the Borrowing from the bank Suisse along with become weighing to the bank’s power to reinforce funds.

In the event the talent rises on the SEC or even the Justice Agency, they sooner or later leaps vessel for these weight NBA deals. Or, in contrast, graduates of your larger corporate businesses capture sabbaticals from their rich life-style to help you slum they within the authorities provider to have a year or a couple of. Many of those visits are inevitably hand-chosen from the lifelong stooges for Wall surface Street such Chuck Schumer, who has approved 14.six million in the promotion contributions from Goldman Sachs, Morgan Stanley or any other significant players on the finance community, making use of their corporate attorneys. When i inquire a former government prosecutor regarding the propriety of a sitting SEC manager of administration speaking aloud regarding the permitting corporate defendants “score solutions” about your condition of the criminal circumstances, he very first doesn’t accept it.

Rating inventory guidance, profile information, and in the Motley Fool’s superior services. Although not, I believe easily have always been incorrect regarding the Fruit as the first 5 trillion stock, it could be since the one of many other brings I mentioned has reached the particular level ultimately. I do believe we are going to find far more away from Apple to your augmented facts side, also — and not featuring its Apple Sight blended-facts earphones. Along with, 6G wireless networks might possibly be readily available by 2030, permitting cool the newest prospective for example watching holographic images in your iPhones. Precisely the anticipation of this you are going to push Fruit over the 5 trillion field later so it 10 years.