Cryptocurrency Risk Management: How to Protect Your Investments

The world of cryptocurrency has seen tremendous growth and popularity in recent years. While it can be a highly rewarding space for investors, it also comes with inherent risks that need to be carefully managed. In this article, we will explore the concept of cryptocurrency risk management and provide tips on how to protect your investments.

Understanding Risk Management

Risk management is the process of identifying potential threats or losses that could impact an investment. In cryptocurrency, risk management involves understanding the different types of risks, such as:

- Market Volatility: Fluctuations in cryptocurrency prices can be unpredictable and volatile.

- Liquidity Risks: Insufficient trading liquidity can lead to significant price swings.

- Regulatory Risks: Changes in government policies or regulations can negatively impact cryptocurrency adoption.

- Security Risks: Cyberattacks, hacking, and other security threats can compromise your investment.

Risk Management Strategies

To mitigate these risks, you need a well-thought-out risk management strategy. Here are some effective strategies to consider:

- Diversification: Spread your investments across asset classes, including traditional stocks, bonds, and commodities.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your investment when it falls below a certain price level.

- Hedging: Use derivatives, such as options or futures, to protect yourself from potential losses.

- Leverage Management: Use leverage (such as borrowing money) to magnify potential gains but also amplify potential losses.

- Tax-optimized strategies: Consider using tax-efficient strategies, such as holding cryptocurrency in a taxable account or using tax-loss harvesting.

Risk management tools

To effectively manage risk, you need the right tools at your disposal. Here are some popular risk management tools:

- Cryptocurrency exchanges with built-in risk management features: Consider exchanges that offer built-in risk management features, such as position limits and stop-loss orders.

- Technical analysis tools: Use technical analysis tools to identify potential trends and patterns in cryptocurrency markets.

- Risk management software: Invest in software solutions that provide risk management strategies, such as algorithmic trading platforms.

BingX vs Bitmex: Which is Right for You?

When it comes to risk management, both BingX and Bitmex offer robust features and tools to help you manage your investments. Here’s a quick comparison:

- BingX: BingX offers a range of risk management features, including position limits, stop-loss orders, and hedging options. It also has a dedicated team to provide support to traders.

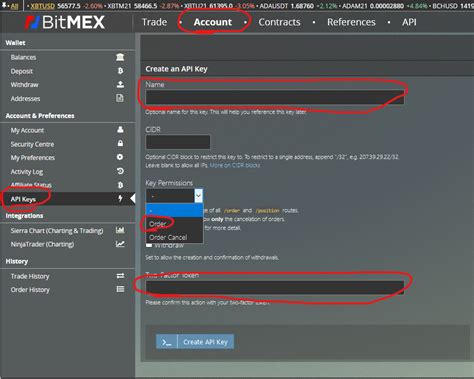

- Bitmex: Bitmex also offers robust risk management features, such as position limits, stop-loss orders, and hedging options. However, its tools may be more limited than BingX.

Conclusion

Risk management is an essential aspect of cryptocurrency investing. By understanding the types of risks involved, implementing effective strategies, using the right tools, and staying informed about market developments, you can protect your investments and achieve success in this fast-paced space. Remember to always educate yourself on risk management principles and remain vigilant when trading cryptocurrencies.

Additional Resources

- BingX Risk Management Guide: Download the complete BingX Risk Management Guide for detailed information on their tools and features.

- Bitmex Risk Management Guide: Explore Bitmex’s risk management resources, including a detailed guide to their tools and strategies.