Unlocking the Potential of Crypto: Understanding Cryptocurrency Capitalization, Transaction Fees, and the Ethereum Virtual Machine

The world of cryptocurrency has come a long way since its inception in 2009. The space is constantly evolving, with new blockchain platforms emerging and existing ones upgrading their technologies to stay competitive. In this article, we’ll delve into three key aspects that play a key role in the growth and success of the cryptocurrency market: Cryptocurrency capitalization, transaction fees, and the Ethereum Virtual Machine (EVM).

Cryptocapitalization

Cryptocurrency capitalization refers to the total value of all outstanding cryptocurrencies on a given exchange or market. The more valuable a cryptocurrency is, the higher its price. This phenomenon is largely driven by investor sentiment, as investors seek out high-performing assets to diversify their portfolios.

In recent years, several cryptocurrencies have seen significant price increases, including Bitcoin (BTC), Ethereum (ETH), and altcoins such as Litecoin (LTC) and Monero (XMR). The sudden price appreciation can be attributed to a variety of factors, such as:

- Adoption by institutional investors

: As more traditional investors enter the market, demand for certain cryptocurrencies increases, leading to higher prices.

- Increased mainstream interest: Growing awareness and acceptance of cryptocurrency among the general public has led to increased adoption, which has driven prices up.

- Regulatory clarity

: Governments around the world are beginning to provide clearer guidance on cryptocurrency regulation, which can increase investor confidence and drive prices up.

Transaction fees

Transaction fees refer to the fees charged by the blockchain network for processing transactions. These fees serve as a way to incentivize miners to secure the network and verify transactions. The more complex the transaction or the larger the amount being transferred, the higher the fee.

Ethereum (ETH) is one of the most popular blockchains due to its scalability, security, and ease of use. As a result, mining Ethereum’s native cryptocurrency, Ether, has become particularly expensive. According to data from Blockstream, ETH transaction fees have grown exponentially over the past few years:

- 2017: Average transaction fee: $0.0005 per byte

- 2020: Average transaction fee: $1.23 per byte

To put that into perspective, one megabyte of data on Ethereum requires approximately 10-20 Ether to process. This makes ETH one of the most expensive cryptocurrencies on the market.

Ethereum Virtual Machine (EVM)

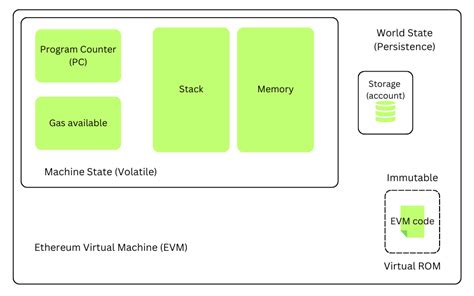

The Ethereum Virtual Machine (EVM) is software that executes smart contracts and decentralized applications (dApps) on the Ethereum blockchain. The EVM provides a runtime environment for these programs, allowing them to interact with other nodes on the network and execute their logic.

Developers can deploy their own dApps on the Ethereum blockchain using various frameworks such as Truffle Suite or Remix. These tools provide a range of features, including:

- Smart Contract Feature: The EVM allows developers to create self-executing contracts with specific rules and conditions.

- Decentralized Governance: The EVM enables decentralized governance models, allowing token holders to participate in decision-making processes.

- Interoperability: DApps built on the EVM can interact with other blockchain platforms using APIs or cross-chain bridges.

The adoption of the EVM has been rapid, and many developers and projects have relied on it to build their own applications. As the Ethereum ecosystem continues to mature, we can expect to see more innovative EVM use cases in the future.