Focused Article: Cryptocurrency Market Analysis – Understanding Bullish and Honeypot Trends

In the world of cryptocurrencies, market trends can be both exciting and volatile. Two terms have garnered particular attention in recent months: “bullish” and “honeypot.” In this article, we’ll break down what each term means, analyze their implications for the cryptocurrency market, and provide insights on how to navigate these trends.

Bullish

A bullish trend refers to a period of price appreciation or growth in the cryptocurrency market. This is often accompanied by growing confidence in the asset’s long-term potential for gains. Bullish investors are optimistic about the future prospects of cryptocurrencies, expecting their value to increase over time. As a result, their buying activity pushes prices up, which can attract more investors and further fuel the bullish trend.

Characteristics of a bull market:

- Increased trading volume

- Upward price movements

- Increasing adoption rates of cryptocurrencies

- Positive sentiment among investors

Honeypot

A honeypot is a term used to describe a cryptocurrency market that has become oversold or overbought, leading to significant price declines. Honeypots are often the result of unrealistic expectations or excessive market optimism. When a market becomes excessively bearish, it can create a “honeypot” effect, in which investors are more likely to sell their holdings, causing prices to drop.

Characteristics of a Honeypot Market:

- Reduced trading volume

- Decreased price movements

- Decreased cryptocurrency adoption

- Negative sentiment among investors

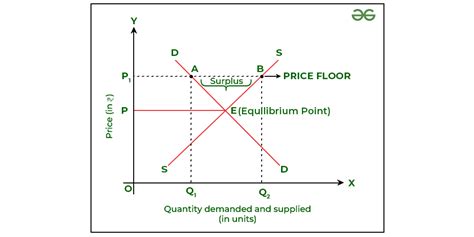

Price Floor

A price floor is the lowest point at which a cryptocurrency can be traded. It represents the minimum value a token can reach before it begins to trade below that level. The price floor serves as a benchmark, indicating the maximum amount of capital a particular asset can command.

Characteristics of a Price Floor:

- A critical hurdle for traders and investors

- Reflects market sentiment and adoption rates

- Can influence trading decisions and buy/sell activity

Navigating Bullish Trends and Honeypot Trends

Understanding bullish trends and honeypot trends is essential to succeeding in the cryptocurrency market. Here are some tips:

- Monitor market indicators: Keep an eye on price movements, trading volume, and sentiment to identify potential bullish trends or honeypots.

- Stay informed

: Stay up-to-date with market news and analysis to make informed buying and selling decisions.

- Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize risk and maximize returns.

- Set realistic expectations: Avoid overestimating the potential of a cryptocurrency, as this can lead to significant losses when it becomes a honeypot.

In conclusion, understanding bullish trends and honeypot trends is essential to navigating the complex world of cryptocurrency markets. By monitoring market indicators, staying informed, diversifying your portfolio, and setting realistic expectations, you can position yourself for success in this exciting and fast-moving space.