“Rethinking Crypto Market Risk: Settlement Risk and Transaction Speed”

The cryptocurrency market has long been associated with high-risk, high-reward trading strategies. However, as the industry continues to evolve and mature, investors are becoming increasingly aware of the potential downsides to their investments. In this article, we will examine two key aspects of the crypto market that can impact investor risk: settlement risk and transaction speed.

Settlement Risk

One of the primary concerns for cryptocurrency traders is settlement risk. Settlement refers to the process of transferring a digital asset from one center or wallet to another, which often involves multiple steps and intermediaries. This process can be slow and complex, which can cause delays in receiving funds or assets.

In fact, the settlement time frames for some popular exchanges are as follows:

- Binance: 1-2 hours

- Kraken: 30 minutes

- Coinbase: 10-20 minutes

Settlement risk is particularly significant for traders who use third-party services such as wallets or brokers to facilitate their trading. In such cases, the settlement process is subject to delays or errors that can lead to losses.

Transaction Speed

Another key aspect of the crypto market is transaction speed. The faster a transaction is completed, the more convenient it is for investors. However, some traders have discovered that certain cryptocurrencies offer significantly faster transaction speeds than others.

For example,

EIGEN (Eigen) is one such cryptocurrency that offers fast and reliable transactions. EIGEN’s underlying blockchain technology processes transactions in seconds, making it an attractive option for high-speed merchants.

Eigen Layer: A Changemaker for Fast Transactions?

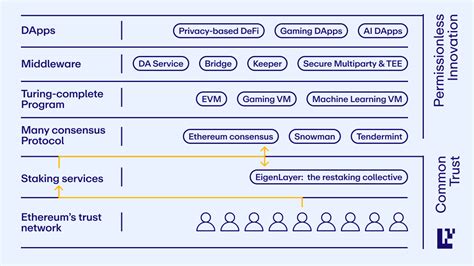

One of Eigen’s key features is its

Layer 2 (L2) scaling solution, which enables faster and cheaper transaction processing. L2 solutions use off-chain data storage to offload compute from the main blockchain, reducing congestion and increasing transaction speeds.

In contrast, traditional blockchain networks such as Bitcoin and Ethereum can be slow due to high transaction volumes and complex routing mechanisms. Eigen’s L2 solution is designed to address these challenges by moving transactions to faster, more decentralized networks.

Conclusion

The crypto market is evolving rapidly, with new technologies and innovations emerging regularly. While settlement risk remains a significant concern for traders, there is also an opportunity to improve transaction speed by leveraging Layer 2 scaling solutions such as Eigen.

As investors continue to navigate the complexities of the crypto market, it is essential to stay informed about the latest developments and risks. By understanding the intricacies of settlement risk and transaction speed, you can make more informed trading decisions and potentially capitalize on new opportunities.