Protecting Your Identity: Using Crypto Cards Responsibly

In today’s digital age, online transactions have become increasingly common. With the rise of e-commerce and digital payments, it’s easy to get lost in a sea of cyber threats. One often-overlooked aspect of online security is protecting your identity while using crypto cards or digital payment methods.

Crypto cards, also known as virtual prepaid cards, are electronic payment cards that can be loaded with cash and used for various transactions. They offer a convenient alternative to traditional credit or debit cards, allowing you to make purchases online and in-person without the need for bank account information. However, using crypto cards responsibly is crucial to protecting your identity.

Why Crypto Cards Pose a Security Risk

Crypto cards operate similarly to physical prepaid cards, but they are electronic and can be easily hacked or compromised if not used properly. Here are some reasons why crypto card security is a significant concern:

- Financial information theft: If a crypto card account is compromised, hackers may be able to access your financial information, including bank account numbers, credit card details, and other sensitive data.

- Phishing attacks: Scammers often target crypto card accounts with phishing emails or messages that appear to come from legitimate sources, such as banks or online retailers. These scams can trick you into revealing sensitive information, leading to identity theft.

- Lack of protection against malware: Crypto cards are not encrypted by default, making them vulnerable to malware and other types of cyber threats.

Protecting Your Identity with Crypto Cards

To use crypto cards responsibly and protect your identity:

- Choose a reputable provider: Select a well-established cryptocurrency exchange or payment processor that prioritizes customer security and has robust encryption methods in place.

- Use strong passwords: Create complex, unique passwords for your crypto card account to prevent unauthorized access.

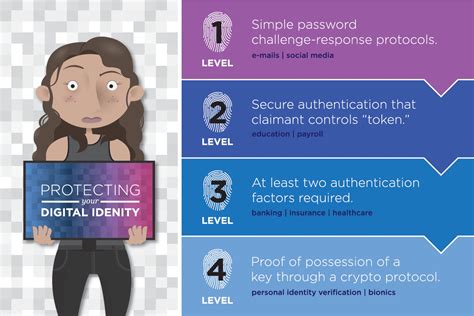

- Enable two-factor authentication (2FA): Enable 2FA whenever possible to add an extra layer of security to your crypto card account.

- Monitor your account activity regularly: Regularly check your crypto card account statements and transaction history to detect any suspicious activity.

- Avoid sharing sensitive information: Refrain from sharing your crypto card PIN or other sensitive details with anyone, including friends, family members, or online retailers.

Best Practices for Using Crypto Cards

To ensure a safe and secure experience using crypto cards:

- Use reputable websites: Only use trusted cryptocurrency exchanges or payment processors that have been vetted by regulatory bodies.

- Be cautious of phishing scams: Be wary of emails or messages that ask you to verify your account information or provide sensitive details.

- Keep your software up-to-date: Regularly update your device, browser, and other software to ensure you have the latest security patches.

- Use a VPN (Virtual Private Network): Consider using a VPN when accessing public Wi-Fi networks to encrypt your internet traffic and protect against man-in-the-middle attacks.

Conclusion

Protecting your identity while using crypto cards requires attention to detail and responsible behavior. By following these guidelines and best practices, you can minimize the risks associated with crypto card usage and enjoy the convenience of online payments without compromising your sensitive information. Remember to always prioritize security and caution when using crypto cards – your financial well-being is worth it.