Limit orders in vs. Market Orders: Understanding the trade differences in cryptocurrency

**

World cryptocurrency trade has become extremely over the body, with many trading platforms and tools where investors can participate. The popular type of orders that merchants gave bus or cell cryptocurrency is limited orders and market orders. While both orders are important tools for navigating cryptocurrency marking, they differentiate the importance of their characteristics and consequences.

What is a market order?

A market order, also known as the “market” order, is something that indicates the best pry to buty or cell currency. When this is done by the March order, it will be executed immediately if you have clarified the prize under your terms. Forests, if the trader wants, but 100 units Bitcoin (BTC) for $ 10,000, you can move to buy an ass for a possible currency march.

Pros and cons of Outside Market Orders:

Pros:

1

Immediate execution : Market orders have fulfilled the specified prize, allowing traders to make their favorite labeling conditions.

- Flexibility : The market orders the toy on the spot, making the beginners for beginners enter the markets.

3

Low risk : Sinnce market orders are fulfilled at a fixed risk of Pare Syms from Undod or over -buying positions.

Cons:

1

Limited Control : Market order traders have limited control over their transactions because they are market control markets and may not have much correction.

- No fill rates : Market orders do not make a filter, which means it will be your favorite position in the market, day style.

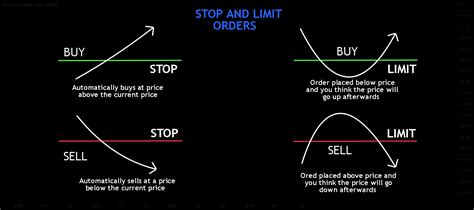

What is the border order?

The restriction order, also known as the “restriction” order, indicates a specific currency prize. Orders, restrictions orders are not completely or nothing and how to marry the topics.

There are type limit orders:

- Stop loss order : stop loss

- Application Order : Profit order is used to lock the profits by selling the profit set automatically) that will reach the trade that will be.

Pros and cons of no limited orders:

Pros:

1

Control and free face : Order limitations to determine special prices, ensure their traditions and easier to adapt to market conditions.

2

Fulfillment article

: Limited orders have high rat rats to bed to bed so that it is executed from the prize that reduces them at that time.

3

Risk Management : Restrictions can help manage your risk by setting everything to determine stops and profit.

Cons:

1

Delayed Execution : Sinnce restriction orders are not fulfilled, trade may be delayed, which may experience delayed opportunities.

- Increased risk : The Limit Order requires the market to be stable and must be evaluated to suddenly have the risk of low armed shrinkage.

Conclusion

Crypto currency trading requires a deep standard that gets rid of market orders and limited orders. As long as market orders are diverted to immediate execution and flexibility, help control control and no fillers. Restrictive orders provide traders with greater control, and flexibility is the requirement of marching shrinkage and risk management strategies.