The relationship between economic indicators and cryptocurrency markets

Cryptocurrency markets have suffered significant fluctuations over the years, led by a complex interaction of economic indicators. While some analysts attribute volatility to market sensation, others argue that underlying economic trends are more crucial to understanding the movements of cryptocurrency prices. In this article, we will deepen the relationship between economic indicators and their impact on cryptocurrency markets.

What are the economic indicators?

Economic indicators refer to the statistical data used to measure economic activity, inflation and growth. These indicators help politicians, analysts and investors to evaluate the health and general direction of a country. Common economic indicators include:

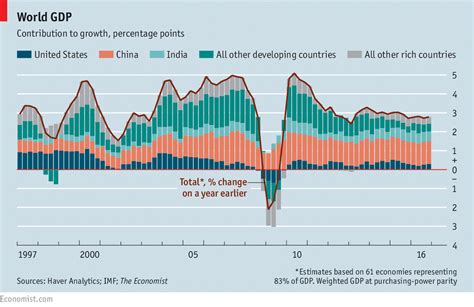

- GDP (Gross Domestic Product)

- Inflation rate

- Unemployment rate

- Interest rates

- Exchange rates

How cheap indicators influence cryptocurrency markets

Cryptocurrencies, such as Bitcoin, Ethereum and others, are strongly influenced by the broader global economy. When economic indicators have a significant impact on cryptocurrency markets, it is often due to the fact that the underlying trends that influence the underlying class of activity reflect.

- GLO GLASS : A strong GDP growth is a key indicator of the economic health of a country, which can increase the demand for cryptocurrencies such as Bitcoin. As economies grow, even digital resources prices.

- Inflation

: High inflation rates can lead to an increase in interest rates and a decrease in cryptocurrency prices. On the contrary, deflationary pressures can lead to higher prices.

3

- Interest rates : Variations in the monetary policy of the Central Bank (for example, increases in interest rates) may have an impact on cryptocurrency prices that influence the cost of loan for investors.

Examples: how economic indicators affect cryptocurrency markets

- The Bitcoin Bull Run 2017 **: As the US economy slowed down and inflation has increased, cryptocurrencies like Bitcoin have suffered a significant increase in the price.

- The Di Covid-19 Pandemia of 2020 : During the central pandemics around the world, it implemented unconventional monetary policies to stabilize economies. This led to a strong increase in cryptocurrency prices, while investors sought activities for the safe brake.

3 Bitcoin and other Altcoin have seen greater volatility due to market uncertainty.

Warnings: Cheap indicators are not the only factor in cryptocurrency markets

While economic indicators play a role in modeling cryptocurrency markets, they are not the only factor in play. Other influential factors include:

- Regulatory environment : Changes in government regulations and policies may have a significant impact on adoption and policies prices.

- Dynamics of supply and supply : The balance between supply and demand determines the price of cryptocurrencies.

- Technological progress : Improvements in the block chain can lead to greater adoption, increasing prices.

Conclusion

Economic indicators are an essential component to understand the relationship between cryptocurrency markets. Although it contributes to the feeling and volatility of the market, trends and underlying factors such as inflation, unemployment, interest rates and demand and demand dynamics play a more important role in modeling cryptocurrency prices. As cryptocurrencies continue to evolve, it is essential that investors are informed about these economic indicators and their impact on the market.

Advice

1.