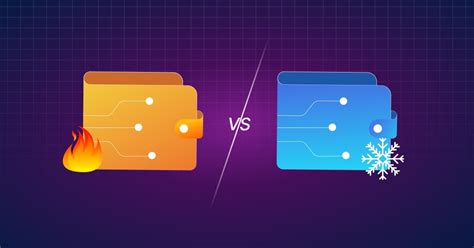

Hardware Wallets and Hot Wallets: What You Need to Know

When it comes to managing digital assets, two terms often come to mind: “hot wallet” and “hardware wallet.” While both devices are used for secure online transactions, they serve different purposes and offer unique advantages. In this article, we’ll explore the differences between hardware wallets and hot wallets to help you decide which one is right for you.

What is a Hot Wallet?

A hot wallet is an electronic device that allows users to securely store, send, and receive cryptocurrencies online. These wallets are connected to the internet, making them vulnerable to hacking and cyberattacks. Accessing funds often requires passwords or PINs, encryption, and other security measures. Hot wallets typically support multiple cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Hot wallets are ideal for:

- Online merchants who need to store their cryptocurrencies for short-term transactions

- Individuals with high financial confidence and willingness to take risks

- Those who prioritize convenience and ease of use

However, hot wallets come with significant security risks, including hacking, fraud, and wallet theft.

What is a hardware wallet?

A hardware wallet, also known as a cold wallet, is an offline device designed to store cryptocurrencies. These wallets require physical access to store coins, making them more secure than hot wallets. They can be locked in a safe or kept at home, reducing the risk of unauthorized access.

Hardware wallets are ideal for:

- Long-term investors who prioritize security and don’t need immediate access to their funds

- People with limited internet access, such as those living abroad

- For those looking for maximum security and peace of mind

However, hardware wallets often come with higher upfront costs compared to hot wallets. Additionally, users should ensure that their wallet is properly secured using strong passwords and two-factor authentication.

Key Differences Between Hardware Wallets and Hot Wallets

| Criteria | hot wallet | Hardware wallet |

| — | — | — |

| Protection Level | Low to Medium | Tier |

| Convenience | Easy Internet access; requires password management | Offline storage, requires physical access |

| Price | Typically cheaper; can be used with multiple cryptocurrencies | Typically more expensive; limited to using one cryptocurrency |

| Risk | High risk of hacking and cyberattacks | Lower risk of hacking and cyberattacks |

Choosing the right wallet

When deciding between a hot wallet or a hardware wallet, consider your specific needs:

- If you are an online trader or investor who makes short-term trades, a hot wallet may also be sufficient.

- If you prioritize maximum security, want to invest in a premium product, and need offline access for long-term storage, a hardware wallet is the best way to go.

Conclusion

In short, both hot and hardware wallets offer unique advantages when managing cryptocurrencies. While hot wallets offer easy internet access and support for more cryptocurrencies, they pose significant security risks. Hardware wallets, on the other hand, prioritize offline security and are ideal for those looking for maximum protection and long-term storage.

Ultimately, it is essential to understand your specific needs and weigh the pros and cons of each option before making a decision. By choosing the right wallet, you can enjoy greater peace of mind and manage your digital assets with confidence.