The Complex World of Cryptocurrencies: Understanding Crypto, Long Positions, FUD, and Consensus Mechanisms

In the fast-paced and ever-evolving world of cryptocurrencies, traders and investors must navigate a complex landscape to maximize their returns. At its core, cryptocurrency markets involve buying and selling digital currencies such as Bitcoin (BTC), Ethereum (ETH), or others using various exchange-traded funds (ETFs) and derivatives.

What is a Crypto?

A cryptocurrency is a decentralized digital currency that uses cryptography for security and is not printed or controlled by any government or financial institution. The most well-known cryptocurrencies are Bitcoin (BTC) and Ethereum (ETH). Cryptocurrencies operate on a network of computers around the world, called nodes, which validate transactions and create new units.

Long Position: A Profitable Strategy

A long position in cryptocurrency is an investment strategy where you buy a digital currency with the expectation that its value will increase over time. This means holding onto your cryptocurrency for several months or even years to ride out market fluctuations.

To be successful, it’s essential to have a solid understanding of the underlying fundamentals of each cryptocurrency, as well as market trends and risk management strategies. Long positions can offer attractive potential returns but also carry significant risks, including price volatility and market downturns.

FUD (Fear, Uncertainty, and Doubt): The Dark Side of Crypto

While some investors view cryptocurrency markets as a thrilling opportunity to profit from the excitement of new technologies, others are concerned about the risks and uncertainties associated with these markets. FUD refers to the spread of negative information or rumors among traders and investors that can create fear, uncertainty, and doubt.

Common types of FUD include:

- Overvaluation: When prices rise too quickly, leading to concerns about market manipulation and potential price bubbles.

- Lack of regulation: Concerns about the lack of regulatory oversight in cryptocurrency markets.

- Security risks: The risk of hacking, theft, or other security breaches that could result in significant losses.

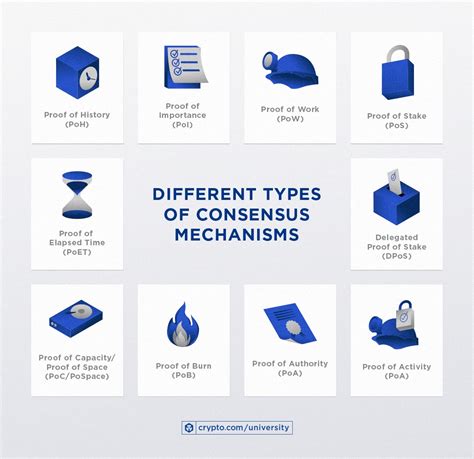

The Consensus Mechanism: A Crucial Aspect of Cryptocurrency

A consensus mechanism is a decentralized process used to validate transactions and create new units in cryptocurrencies. It’s essential for maintaining the integrity and stability of the network. The most widely used consensus mechanisms are:

- Proof-of-Work (PoW): Involves miners competing to solve complex mathematical puzzles, using their computers’ processing power.

- Proof-of-Stake (PoS): Involves validators who hold a certain amount of cryptocurrency in their possession, rather than requiring computational power.

Conclusion

Cryptocurrencies and the cryptocurrencies market can be complex and volatile. To succeed, it’s essential to have a solid understanding of the underlying principles, risk management strategies, and FUD dynamics. By staying informed and adaptable, traders and investors can navigate these markets with confidence.

Here are some key takeaways:

- Understand the fundamental concepts of cryptocurrency and its uses.

- Develop a well-thought-out strategy for your investment, including risk management techniques.

- Stay informed about market trends and FUD dynamics through reputable sources.

- Be cautious of unsolicited information or speculative claims.